How To Set Up A Nonprofit Organization In New York

How to Start a Nonprofit Arrangement in New York

There are many good reasons tokickoff a nonprofit in New York, but knowing the commencement few steps to have tin be challenging.

Nosotros'll help you start a nonprofit and complete your501(c)(3) application in our How to Start a Nonprofit in New York guide beneath.

Or, only apply a professional service:

Incfile (Starting at $0 + Land Fees)

Starting a 501(c)(3) Nonprofit in New York is Easy

To starting time a 501(c)(three)tax-exemptnonprofit organization in New York, you must firststart a New York nonprofit co-ordinate to the rules of the land thenapply for501(c)(iii) status with the IRS.

Larn more than about 501(c)(iii) eligibility in our What is a 501(c)(three) guide.

Toform a 501(c)(iii) nonprofit organization, follow these steps:

Step one: Proper noun Your New York Nonprofit

Stride ii: Choose Your Registered Amanuensis

Pace 3: Cull Your Nonprofit Type

Pace four: Select Your Board Members and Officers

Step 5: Adopt Bylaws & Disharmonize of Interest Policy

Step 6: File the Certificate of Incorporation

Footstep vii: Get an EIN

Due south tep viii: Apply for 501(c)(3)

Step 1: Name Your New York Nonprofit

Choosing a name for your arrangement is the outset and most of import step in starting your nonprofit corporation. Be sure to choose a proper noun that complies with New York naming requirements and is hands searchable past potential members and donors.

To acquire more, read our How to Proper noun a Nonprofit in New York guide.

ane. Follow the naming guidelines:

- Include some kind of organizational designation, such equally "Incorporated", "Inc.", "Ltd.", or "Visitor"

- Not exist deceptive in any way or indicate your organization was designed for any purpose other than what is stated in your Certificate of Incorporation

- Non include words or phrases that could lead the public to believe your organization is interim every bit an amanuensis of the United States or the State of New York

- Not include whatever of these words or phrases:

- physician or lawyer (unless you obtain special permission)

- union, labor, quango, industrial organization (when pertaining to worker's rights, unless y'all attach an approving from the land board of standards and appeals)

- blind or handicapped (unless you attach an approval from the state section of social services)

- substitution (unless y'all attach approval from the attorney general)

- school, instruction, unproblematic, secondary, kindergarten, prekindergarten, preschool, nursery school, museum, history, historical, historical order, arboretum, library, higher, university, or other restricted terms (unless you attach approval from the state commissioner of pedagogy)

- In add-on, your nonprofit's proper noun cannot use words or phrases that are considered obscene or ridiculing any person, group, belief, etc. or indicate that your grouping will engage in unlawful activity.

Access the New York State Senate'southward official guidelines for more information about naming a nonprofit in New York.

2. Is the name available in New York? Brand certain the proper noun you lot want isn't already taken by doing a business organization entity search on the NYS Division of Corporations website.

3. Is the URL available? We recommend that you check to see if your business name is available as a spider web domain. Fifty-fifty if you don't plan to make a business organisation website today, yous may desire to buy the URL in club to foreclose others from acquiring it.

Find a Domain Now

Registered your domain name? Next, we suggest choosing a business phone system to help your nonprofit build authority and trust. Phone.com is our first pick due to its affordability and top-notch customer support. Effort Phone.com today.

Footstep 2: Choose a Registered Agent in New York

In New York, the Secretary of Land acts equally the statutory agent for service of process (registered agent) for all New York organizations by default.

In addition, you tin can choose to elect a registered agent for your New York organization. You will be given this option when you complete your business organization'southward formation documents.

What is a Registered Agent? A registered agent is an private or business entity responsible for receiving of import legal documents on behalf of your business. Call back of your registered agent as your business's point of contact with the state.

Who can be a Registered Agent? A registered agent must be a resident of New York or a corporation, such every bit a registered agent service, authorized to transact business concern in New York. You may elect an individual within the company including yourself.

Footstep 3: Choose Your Organisation Type

Before proceeding farther, you must decide what kind of corporate structure your organization will have and obtain whatsoever approvals yous might need. You volition need to choose from the following options:

- Religious Corporation - in that location are distinct rules and regulations that are applicative to religious corporations operating in New York. Admission farther information about starting a religious organization in New York in the Consolidated Laws of New York.

- Nonreligious Corporation

- Consent or Approving Required - If your nonprofit's purpose is related to whatsoever of the following in the graph below, you must obtain approval from the advisable governing body. This approval must accompany your Document of Incorporation application.

| Organization'due south Purpose | NY Government Agency |

|---|---|

| 404(a) formation of a merchandise or business association | NY Attorney General |

| 404(b) adult intendance facility, victims of domestic violence, care of dependent children, adoption, foster care, etc. | Children - Children and Family unit Services Adults - Commissioner of Health |

| 404(c) operation of a infirmary or health service, or medical/dental indemnity plans | Commissioner of Wellness |

| 404(d) functioning of a academy, school, higher, museum, library, or historical social club or any other purpose in which the organisation might be chartered by the Board of Regents | Commissioner of Education |

| 404(east) cemeteries | Cemetery Board |

| 404(f) burn corporation | Government in your local city/hamlet/town |

| 404(k) prevention of animate being cruelty | American Society for the Prevention of Cruelty to Animals OR Certified copy of an gild past the justice of your local supreme court |

| 404(h) YMCA | YMCA Chairman |

| 404(i) raise funds for or benefit the armed forces | Aide General |

| 404(j) labor unions and similar organizations | Industrial Board of Appeals |

| 404(1000) promotion of banks, life insurance, or interests of member banks | Superintendent of Fiscal Services |

| 404(l) insurance agents, brokers, underwriters or independent laboratories (and more) | Superintendent of Financial Services |

| 404(k) includes the name of a political political party | Chairman of your local canton's political party of the aforementioned name |

| 404(n) includes the words American Legion | American Legion Department of New York |

| 404(o) (t) maintenance of a hospital or soliciting contributions for such a purpose | Public Wellness and Planning Quango |

| 404(p) medical corporation | Commissioner of Health AND Public Wellness and Planning Council |

| 404(q) establishing or operating mental health facilities | Commissioner of Mental Wellness |

| 404(r) wellness maintenance organization | Commissioner of Wellness |

| 404(u) establishment or operation of a substance abuse program or soliciting donations on behalf of ane of these programs | Commissioner of the Part of Alcoholism and Substance Abuse Services |

| 404(v) establishment, operation, and maintenance of a nonprofit casualty and/or property insurance company | Superintendent of Financial Services |

Read total descriptions of each of these categories in Section 404 of the New York Country Senate's requirements for nonprofit corporations

No Consent or Approving Required - if your nonprofit does non fall into one of these categories, you lot exercise non take to submit additional approval information with your Certificate of Incorporation application.

Step 4: Select your Directors & Officers

The directors of an organization come together to grade a board of directors. This board of directors is responsible for overseeing the operations of the nonprofit.

The president, secretary, and other members of nonprofit who take private responsibilities and authorities are known equally officers.

The organisation structure of your nonprofit in New York MUST include:

- At least 3 directors not related to each other

- A president

- A minimum of 1 vice president

- A secretary

- A treasurer

NOTE: The president and secretary positions cannot exist held by the same person.

To larn more than about electing a New York nonprofit lath of directors, read our total guide.

Step 5: Adopt Bylaws & Disharmonize of Involvement Policy

To be eligible to employ for 501(c)(3) status, your nonprofit is required to accept the following two documents:

- Bylaws

- Conflict of interest policy.

What are Bylaws? Bylaws are the rules outlining the operating procedures of the nonprofit.

What is a Conflict of Interest Policy? A Conflict of Involvement Policy is the collection of rules put in place to ensure that any decisions made by the board of directors or the officers benefits the nonprofit and non private members.

Annotation: The bylaws and conflict of interest policy must exist adopted by the nonprofit during its get-go organizational meeting where the directors and officers are officially appointed.

Step 6: File the New York Certificate of Incorporation

To register your nonprofit, yous will need to file the Certificate of Incorporation with the State of New York.

To ensure that your nonprofit is eligible to employ for 501(c)(3), in the Certificate of Incorporation you must explicitly state the following:

ane. Purpose:

In society to qualify for 501(c)(3) status, the organisation's purpose must explicitly exist limited to i or more of the post-obit:

Charitable, Religious, Scientific, Educational, Literary, Fostering national/international apprentice sports competition, Preventing cruelty to animals/children, Testing for public safety

two. Dissolution:

You must explicitly state what the assets of the organization will be used for, and what will happen to the avails if the organization is dissolved.

To exist eligible for 501(c)(iii) status, the assets of your system must only ever be used for purposes canonical under section 501(c)(three).

Section five of this sample IRS document provides an example of these provisions required for 501(c)(3) eligibility.

File the Document of Incorporation

File Form DOS 1511 by Mail, by Fax, or In Person

Download Form

Country Filing Cost: $75

Filing Address:

Department of Land Division of Corporations

Land Records and Uniform Commercial Code

Ane Commerce Plaza

99 Washington Ave.

Albany, NY 12231

Fax:(518) 474-1418

Notation:Fax filings must include a Credit Card/Debit Bill of fare Authorization form.

Footstep seven: Get an EIN

What is an EIN? The Employer Identification Number (EIN), or Federal Tax Identification Number, is used to identify a business concern entity such equally your nonprofit corporation. It is essentially a social security number for your organization.

Why do I need an EIN? An EIN is required for the following:

- To open a business banking company account for the visitor

- For Federal and State tax purposes

- To rent employees for the visitor

How exercise I become an EIN? An EIN is obtained from the IRS (costless of charge) by the concern owner later forming the company. This can exist done online or past mail service. Check out our EIN Lookup guide for more than information.

Step 8: Apply for 501(c)(3) Condition

Before a nonprofit can utilise for 501(c)(3) condition it must,

- Elect at least 3 directors not related to each other

- File the Certificate of Incorporation with the required provisions (As covered in Step 6)

- Prefer the bylaws and disharmonize of interest policy

- Have an EIN number

Once these four atmospheric condition have been met your nonprofit tin can apply for 501(c)(3) tax-exempt status past filing Form-1023 online.

If your application is approved, the IRS will send yous a conclusion letter stating that your organization is exempt from federal taxes under department 501(c)(iii).

FAQ: Starting Your Nonprofit

When should an organisation apply for federal revenue enhancement exemption?

Grade 1023 must be filed inside 27 months from the terminate of the first month your organization was created.

How long will it take for the IRS to process Form 1023/1023-EZ?

Before long after sending your application you should receive an acknowledgment of receipt of your application.

If your awarding is simple and consummate, IRS will transport your conclusion letter within 180 days for Course 1023

If you have non heard from them by that time yous can call (877) 829-5500 to enquire about your awarding.

Find out which nonprofit formation service is the best for you in our review on Startup Savant.

Important Steps Afterwards Forming a Nonprofit

Business Banking

one. Opening a business depository financial institution account:

- Separates your personal assets from your visitor'due south assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

To open a bank account for your nonprofit corporation you volition typically need the following:

- The EIN for the nonprofit

- A copy of the nonprofit'due south bylaws

- A copy of the Certificate of Incorporation

Read our All-time Small Business concern Banks review to detect the right bank for your nonprofit'south needs.

two. Getting a business organisation credit card:

- Helps yous split up personal and business organization expenses.

- Builds your visitor's credit history, which tin can be useful to enhance capital later.

3. Hiring a business accountant:

- Prevents your business from overpaying on taxes while helping you avoid penalties, fines, and other costly tax errors

- Makes accounting and payroll easier, leaving you with more than time to focus on your growing business

- Helps effectively manage your business funding and discover areas of unforeseen loss or extra profit

For more business bookkeeping tools, read our guide to the all-time business accounting software.

Become Insurance

Business insurance helps you manage risks and focus on growing your business concern.

The almost mutual types of business organization insurance are:

- General Liability Insurance: A broad insurance policy that protects your business from lawsuits. Nigh modest businesses become general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers (consultants, accountants, etc.) that covers against claims of malpractice and other business organization errors.

- Workers' Compensation Insurance: A blazon of insurance that provides coverage for employees' chore-related illnesses, injuries, or deaths.

Recommended:Inform your employees about their rights and stay compliant past posting labor law posters in your workplace.

Build a Business Website

Creating a website is a big step in legitimizing your business. As a nonprofit, your website volition be the primary style to share your arrangement's mission and story to supporters. Your website should exist a great resource for anyone interested in your nonprofit's upcoming events, goals, and news to help accelerate your cause.

Some may fear that creating a business website is out of their reach because they don't accept any website-building feel. While this may have been a reasonable fear back in 2022, spider web technology has seen huge advancements in the past few years that makes the lives of modest business owners much simpler.

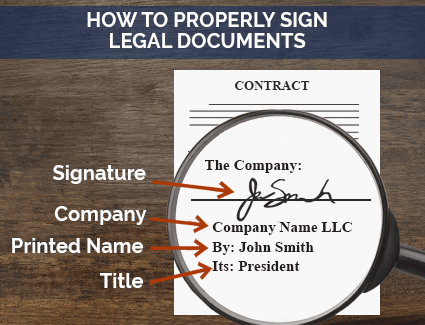

Properly Sign Legal Documents

Improperly signing a document as yourself and not every bit a representative of the business concern can leave you lot open to personal liability.

When signing legal documents on behalf of your nonprofit, you could follow this formula to avoid problems:

- Formal name of your organization

- Your signature

- Your name

- Your position in the business every bit its authorized representative

See the image below for an example:

This ensures that you are signing on behalf of your nonprofit and not as yourself.

State of New York Quick Links

- IRS - Data for Charities & Nonprofits

- IRS - Required Provisions for Organizing Documents

- IRS - 990 Series for Tax-Exempt Organizations

- IRS - Applying for Tax-Exempt Status

- IRS - 501(c)(iii) Compliance Guide

- Small Business organization Assistants - License and Permits

- New York Department of State - Nonprofit Corporation Forms

- New York Section of State - Business Services

- NY Senate - Business organisation Corporation Statutes

- New York Section of Taxation and Finance

- New York Country Charities Partitioning

New York Business Resources

Have a Question? Leave a Comment!

How To Set Up A Nonprofit Organization In New York,

Source: https://howtostartanllc.com/form-a-nonprofit/new-york-nonprofit

Posted by: thompsonnithe1984.blogspot.com

0 Response to "How To Set Up A Nonprofit Organization In New York"

Post a Comment